The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, continues the government’s emphasis on infrastructure-led growth, fiscal consolidation, and sectoral reforms to propel India toward Viksit Bharat. With public capital expenditure (capex) raised to a record ₹12.2 lakh crore (approximately 3.1-4.4% of GDP, marking a roughly 9% increase from the previous year’s allocation), the Budget prioritizes large-scale projects, urban expansion, energy security, and risk mitigation to sustain momentum amid global uncertainties. The fiscal deficit is targeted at 4.3% of GDP, reflecting prudent balancing of growth and discipline.

Key measures include the establishment of an Infrastructure Risk Guarantee Fund to de-risk private developers during construction phases, allocations for City Economic Regions (CERs) at ₹5,000 crore per region over five years, new Dedicated Freight Corridors, high-speed rail corridors as “growth connectors,” and focus on Tier-II and Tier-III cities to drive balanced urbanization.

Infrastructure Sector Gains Momentum

Industry leaders welcomed the sustained capex push and risk-mitigation tools, viewing them as catalysts for execution efficiency, project viability, and long-term demand in construction and related materials.

Aparna Reddy, Executive Director, Aparna Enterprises Ltd., stated:

“We welcome the Union Budget 2026–27, which reinforces infrastructure as a key pillar of India’s growth journey. The enhanced capital expenditure allocation of ₹12.2 lakh crore signals continued support for large-scale construction and connectivity projects, helping sustain momentum across the infrastructure ecosystem. The proposed Infrastructure Risk Guarantee Fund addresses an important challenge in project execution by helping mitigate risks during the construction and early development phases. By improving financing confidence for developers and lenders, this measure can contribute to stronger project viability and more predictable execution timelines. The Budget’s emphasis on planned urban development through City Economic Regions, along with continued infrastructure expansion in Tier II and Tier III cities, reflects an approach that supports more balanced urban growth beyond traditional metropolitan centres. As these emerging cities continue to grow, improved connectivity and infrastructure are expected to drive demand for housing, commercial real estate, and supporting urban amenities. This expansion will translate into sustained construction activity and steady demand for high-quality building materials such as cement and concrete. The scale and spread of infrastructure initiatives outlined in the Budget create a conducive environment for long-term capacity building in the construction sector, supporting the development of resilient cities and addressing the evolving needs of a rapidly urbanising population.”

Rajesh Kumar Singh, CEO, Jyoti Structures Ltd., highlighted the power transmission angle:

“The Union Budget 2026–27 provides a strong and sustained policy signal for the expansion and modernisation of India’s power transmission and infrastructure ecosystem. The continued thrust on public capital expenditure, development of new Dedicated Freight Corridors, creation of city economic regions, and targeted investments to ensure long-term energy security are critical enablers for strengthening the national grid and supporting India’s growing power demand. Measures such as the proposed Infrastructure Risk Guarantee Fund and accelerated asset monetisation through REITs are expected to improve financing confidence, reduce execution risks and facilitate timely completion of large-scale EPC projects. For Jyoti Structures, with a proven track record in executing extra high-voltage transmission lines, substations and turnkey grid projects across India and international markets, the Budget creates a conducive environment to support grid expansion, renewable energy integration and cross-regional connectivity, while reinforcing India’s broader electrification and infrastructure development priorities.”

Anantha Keerthi, Senior Partner, Vector Consulting Group, offered a balanced perspective on execution challenges:

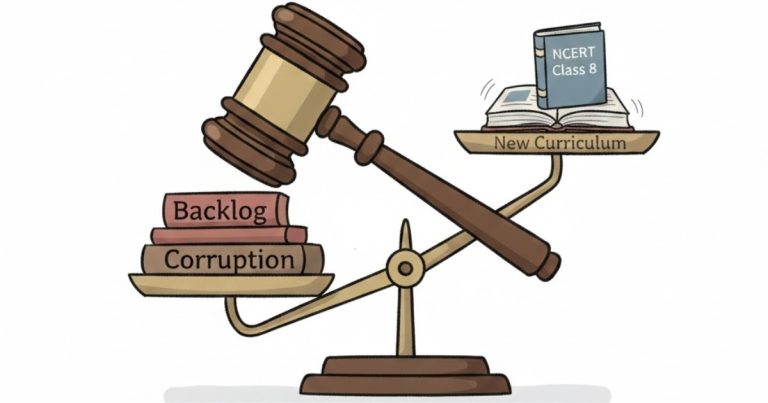

“For the financial year 2026–27, the government has proposed increasing capital expenditure on infrastructure to ₹12.2 lakh crore, reinforcing the momentum built over recent years. This underscores infrastructure’s central role in India’s growth and development strategy. However, persistent challenges remain, as higher allocations alone do not automatically resolve cost and schedule overruns. The real test will be whether this increased outlay translates into stronger upfront project design and more robust Detailed Project Reports (DPRs). Most large infrastructure projects in India experience 55%–60% cost overruns and 30%–70% time overruns, largely stemming from weak early-stage planning, particularly inadequate DPRs. A portion of the budget must therefore be explicitly directed toward rigorous pre-construction planning. High-quality DPRs reduce delays, rework, and disputes, unlocking significant savings and enabling the country to build more infrastructure with the same resources. Strengthening investment in pre-construction activities can play a pivotal role in improving timelines, coordination, and long-term project performance.”

Boost for MSMEs, Services, and Related Sectors

The Budget supports MSMEs through a ₹10,000 crore SME Growth Fund and other credit/digital enhancements, while initiatives in skilling, design, and tourism align with broader services growth.

Shezaan Bhojani, CEO & Co-founder, DesignCafe, noted the home interiors impact:

“The Union Budget 2026 provides a significant impetus to India’s organised home interiors and renovation sector. Measures supporting MSMEs, the establishment of a new Design Institute in Eastern India, and a strong emphasis on future-ready skills and AI adoption within the services sector collectively encourage innovation, entrepreneurship, and technology-led growth. The focus on infrastructure development across Tier-II and Tier-III cities will expand the sector’s reach beyond major metros, enabling design and renovation businesses to serve a wider base of homeowners. Taken together, these initiatives are expected to enhance consumer confidence, stimulate housing demand, and accelerate the professionalisation of the interior design ecosystem while generating meaningful employment opportunities.”

Akansha Agarwal, Co-Founder & CMO, Int2Cruises, praised the tourism push:

“The Union Budget 2026 underscores the government’s strategic focus on strengthening India’s tourism sector. Initiatives such as the establishment of a National Institute of Hospitality, large-scale training of tourist guides, and the enhancement of trekking and heritage trails highlight a clear commitment to improving domestic travel experiences. At the same time, the reduction of TCS on overseas tour packages to 2% is a well-timed move that improves affordability and reinforces traveller confidence. Together, these measures are set to drive growth across both domestic and outbound tourism, promote premium travel segments such as cruises, and support the long-term development of a resilient tourism ecosystem.”

Anil Tadimeti, Director, Strategy & Regulatory Affairs, Bureau, commented on financial sector and AI aspects:

“The Union Budget 2026–27 underscores the government’s focus on MSMEs as a key engine of economic growth, with a clear emphasis on improving access to credit and strengthening the digital frameworks that support it. As credit delivery becomes increasingly digital, technology-led approaches to risk assessment and trust will be essential to ensure that growth is inclusive, responsible, and sustainable. The proposal to constitute a High-Level Committee on Banking for Viksit Bharat is a significant step toward reviewing the financial sector across banks and NBFCs, with an emphasis on regulatory efficiency, long-term resilience, and effective use of technology. We see the comprehensive review of compliance and operating frameworks as a welcome step toward simplifying processes, reducing friction, and enabling financial institutions to scale while prioritising consumer protection. This is further complemented by initiatives like the rationalisation of IT services under a single category with a uniform safe harbour margin of 15.5% and an expanded threshold of ₹2,000 crore. Together, these measures signal strong policy attention on financial sector resilience and its multiplier effect on the broader economy. One area that we, as part of Bureau, would want further articulation on is India’s approach to AI and emerging AI-led capabilities, including both their transformative potential and associated risks. While the Budget does not outline specific AI provisions, the broader direction points toward sector-specific regulation. Clarity on how regulators and ministries intend to leverage AI to deepen digitisation, expand financial inclusion, and strengthen digital trust while putting guardrails in place to address AI-driven misuse and adversarial threats is critical, and we look forward to it.”

Overall, the Budget 2026-27 reinforces infrastructure as the bedrock of India’s economic resilience, while addressing execution hurdles, de-risking investments, and fostering inclusive growth in construction, power, MSMEs, design, and tourism. Industry voices see it as a pragmatic step toward sustained momentum, though calls for stronger pre-planning and regulatory clarity persist to maximize impact.

Last Updated on: Wednesday, February 4, 2026 9:59 pm by News Vent Team | Published by: News Vent Team on Wednesday, February 4, 2026 9:59 pm | News Categories: Business